The Department of Economics conducts an Economics Research Symposium every spring. They are a valuable experience for Economics students who want to present research they have been working on during the academic year. Research projects are from independent studies, research courses, or any class where the student worked on a project, paper, or research. Some of the research is in the proposal form or will be ongoing, while others are completed projects.

2020 Research Symposium Presentations

Research Presentations

Amena Ahmed

Francis Fang

Married Women's Characters that determined Involvement in Labor Force in 1975

Juntao Ke

Elizabeth Kepner

To Server or Protect: An analysis of civilian injuries by the Chicago Police Department

Michael Bernhardt

Prediciting Default on Peer to Peer Loans

Alan Adrade

Shangya Xu

2019 Research Symposium Presentations

Research Presentations

Applying Machine Learning in Predicting Red Wine Quality

Jiewen Han

Abstract: Using a variety of algorithms I am learning from the course Econ 490: Applied Machine Learning in Economics, I am building different machine learning models to analyze and predict which factors can best predict the quality levels of the red wine in a provided dataset.

The Overall Effects of the Ebola Outbreak on Birthweight

Farzad Saif

Abstract: There have been many studies attempting to find the effects of the fetus to the birthweight of children. My paper (which I present on) examines the relationship between the overall effects of the Ebola outbreak on birthweight, using 4,185 women living in Sierra Leone. To identify causal effects, I assume that the respondents didn’t plan their pregnancies around the crisis. I find that the crisis lowered birthweight by 0.042 (SE = 0.017) kilograms at 5% significance. The average birthweight in the control group is 3.223 (SD = 0.522) kilograms. This amounts to a 1.300% change in birthweight from the treatment. In addition, I tested if urban or rural areas would have differential effects. With the interaction term I find that birthweight decreased by 0.034 (SE = 0.019) kilograms at 10% significance. This paper demonstrates that the Ebola outbreak is suggestive of effects on fetal health.

Factors of Income: Machine Learning Analysis of US Census Salary Data

Jordan Evans-Kaplan

Abstract: Economists since Smith have studied social mobility and the factors which differentiate a lifetime of prosperity from a lifetime of poverty. However, only in the modern era has the data existed to make broad models of entire populations. Using US Census Data with a sample population of 32,561 separate individuals, a series of models have been trained and prepared to estimate the income bracket of an individual. For the purpose of this analysis, the two income response factors are <=50K, >50K. In order to analyze this data, a series of econometric techniques were utilized, including multiple logit regressions, lasso and ridge regressions, classification trees, and gradient boosting. Through a combination of these techniques, my analysis obtains a prediction accuracy of roughly 87% on out of sample individuals. Similar subjects have been studied in papers such as “Education and Lifetime Earnings” by Tamborini et al.

Applied Machine Learning on Predicting Diamond Prices

Xuan Lin

Abstract: Predicting diamond prices has been a challenging task because there are various characteristics associated with diamonds. Despite this, there are some pricing charts being used in the diamond retail market. The pricing methodologies are not transparent and some of the charts are not even accessible to public. This research aims to apply machine learning techniques to establish a price prediction model based on physical characteristics of diamonds. After comparing different models, boosting regression outperforms others by having the highest prediction accuracy. Diamond weight-size turns out to be the most important predicting variable, while cut quality only has a trivial effect on price.

Estimating Income Determinants and Optimizing Tax Rate over a Dynamic Function

Hassam Rahim Kamil

Abstract: This paper aims to illustrate the income determinants of households using different methods employed in machine learning and then use them to predict incomes in a future dataset. It will dive into the question whether taxing based on lifetime income is better taxing on current income.

Modeling Price of Ethereum with Machine Learning

Scott Cilento

Abstract: Ethereum is a blockchain based platform with smart contracts. The technology is essentially a distributed decentralized ledger database system that is append only. This means that past transaction data cannot be changed. Ethereum rose to the public eye when in late 2017 to early 2018 the market cap of the cryptocurrency ether, a part of the ethereum technology, rose from less than $1 per ether to more than $1000 per ether. I will be analyzing the price of ether as it relates to other data on the ethereum blockchain. Specifically, I will take a look at the block size- which is a measure of transaction throughput, the growth rate of the hash rate- which is a measure of the processing power of the ethereum network, number of transactions on the network, days of the week, and months. The question here is simple- How is the price of an ether affected by the block size, the hash rate, transactions, the day of the week, and the month? To try to answer this question, I have deployed various machine learning methods on my data, including OLS regression, random forest, boosting, bagging, and a neural network. Results and comparisons of the effectiveness of each method are shown in my research.

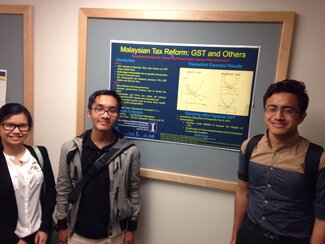

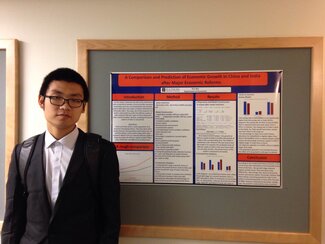

2018 Research Symposium Presentations

| Research Presentation |

|---|

|

Measuring Stochastic Long-Range Dependence: Calculating the Hurst Exponent of the S&P 500 Ajay Dugar Abstract: Underlying the foundations of modern financial theory is a series of faulty mathematical assumptions, stemming from Louis Bachelier’s work with Parisian bonds. From this, our modern orthodox financial theory has been built (Black-Scholes, β’s, CAPM, EMH, etc.). By using fractal and statistical analysis, we can deconstruct these myths and establish a better understanding of the true volatility of markets. |

|

Exporting Uncertainty: The Impact of Brexit on Corporate America Lilla Szini Abstract: The main goal in this project is to analyze the work patterns and levels of education from every county in the U.S. from 2010 to 2017 to observe the impact of Brexit in corporate America. This is done by analyzing several factors across the U.S. in terms of employment, activities of firms, trading of goods, and income particularly focusing in on white Americans with no greater than a high-school level education. The changes that occurred in 2017 due to Brexit impacted several aspects of the U.S. and gathering data from the U.S. census sheds some light on some of these implications. |

|

Measuring the Effect of Unemployment on Juvenile Delinquency Zhao Zhang Abstract: In this research, I measure the relationship between Unemployment and Juvenile Delinquency. Previous theoretical and empirical research on Unemployment-Crime correlation are reviewed. On this basis, an empirical study is carried out with China’s province-level data published by Chinese Supreme Court. As the multivariate regression model contains a set of social, economic, and demographic variables, I also discuss alternative calculation methods for economic indicators such as unemployment rate and income inequality. To obtain valid estimations with multicollinearity in data, methods like Ridge regression and Bootstrap are used. Results show that there is a significant positive relationship between Unemployment and Juvenile Delinquency. Future improvements on more robust and precise estimates as well as possible intervention methods for juvenile delinquency are discussed. |

|

|

2017 Research Symposium Presentations

Observing Childcare Workers’ Socioeconomic Status (Huiyi Chen)

China: The Effect of the Gender of First Born Child to the Parents’ Retirement Age (Allen Hardiman)

Positive Analysis of Pigouvian Tax under Different Market Structures (Xingjian Angel Ren)

Effects of the Loss of the Central Bank’s Money-Issuing Role (William Kozlowsk)

Internet, Competitive Advantage and Manufacturing Upgrading (Hesong Yang and Yabin Bian)

Cross-Industry Income Elasticity (Fan Wu)

How Financial Markets around the World Responded to Shocking Political Events (Ziheng Xiao)

The Long-Term Impacts on Cognitive Development of Political Movements in Chinese Cultural Revolution: 1966-1968 (Jian Zou)

2016 Research Symposium Presentations

Add Text

2015 Research Symposium Presentations

Estimating the Price Elasticity of Electricity: Evidence from Municipal Electric Aggregation (Aishwarya Gautam)

U.S. Personal Income Emperical Evidence (Chang Lou)

Measuring the Success of Soy in Northern Ghana (Ryan Highfill)

Online Change Detection with Applications to Internet Security (Yitian Tang)

How did Chinese Yuan Appreciation Affect Export Diversification? (Yue Ao)